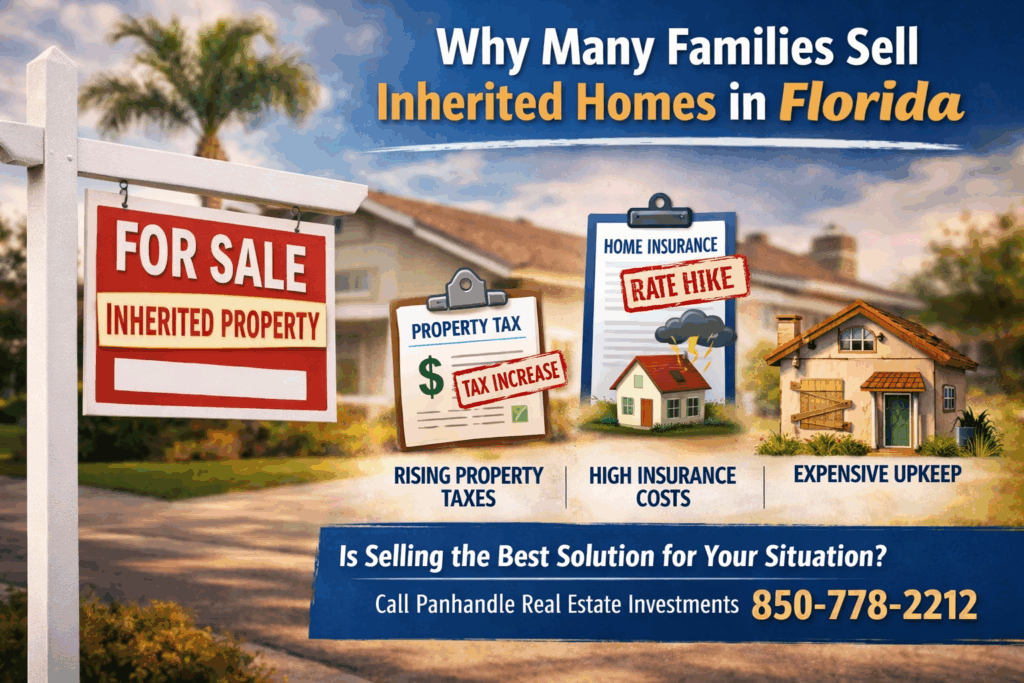

Why Families Who Inherit Houses in Florida Often Decide to Sell

Most people imagine inheriting a home as a financial gift.

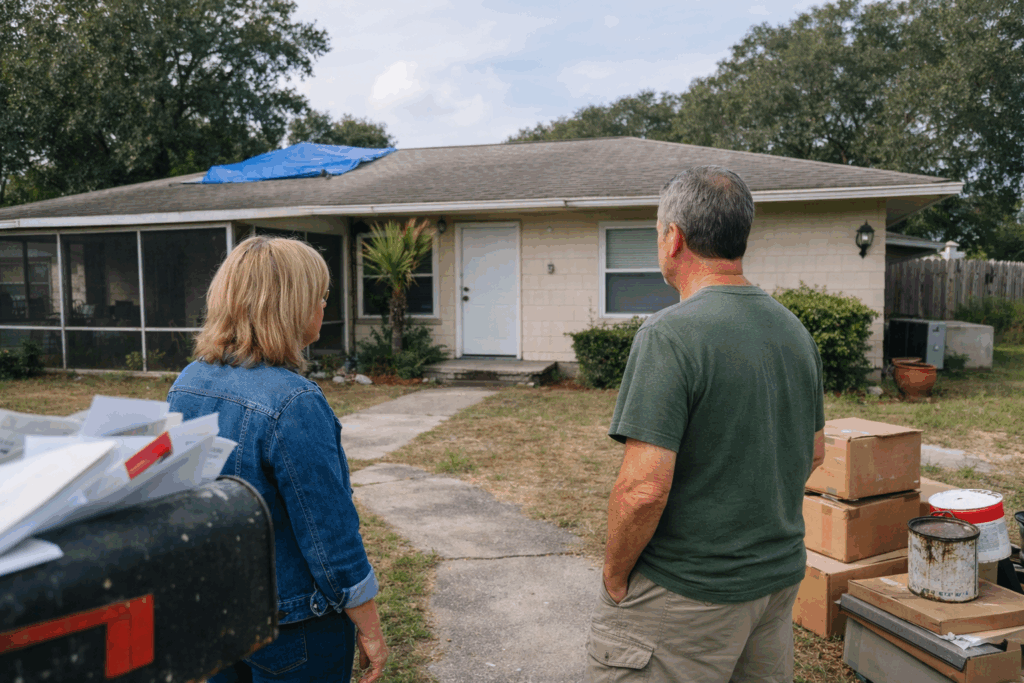

But when families begin handling the paperwork after a loss, the house often changes meaning quickly. The memories are still there the familiar layout, the same driveway yet the mailbox starts filling with things no one was planning for: insurance notices, tax statements, and maintenance responsibilities.

The shift feels abrupt.

The home hasn’t changed, but the cost of keeping it has.

In Florida especially, ownership after inheritance operates under a completely different set of rules than it did for the person who lived there.

The Property Doesn’t Reset Emotionally, But It Does Financially

Many longtime Florida homeowners lived in their house for decades. Over time they benefited from stable taxes, long-standing insurance policies, and routine maintenance that happened gradually.

When ownership transfers, those conditions often disappear at once.

Families frequently expect to decide what to do with the home first and deal with expenses later. In reality, expenses begin immediately often before probate is even finished.

Property Taxes Are Usually the First Surprise

Florida’s homestead exemption protects primary residents from large yearly tax increases. Those protections belong to the owner, not the property.

After a death, the exemption commonly ends or changes. The assessed value moves closer to market value, and the annual bill adjusts accordingly.

What Many Families See

| Long-time owner | After inheritance |

|---|---|

| About $1,200/year | About $3,000–$5,000/year |

Source: Florida homestead exemption and Save-Our-Homes assessment limitation rules.

The house didn’t become more valuable overnight but from a tax standpoint, it now behaves like a newly purchased property.

Insurance Is Often the Real Turning Point

Taxes raise concern. Insurance often determines the outcome.

Florida insurance policies are closely tied to occupancy and risk. After inheritance, the insurer may require a new policy, particularly if the home becomes vacant or has an older roof.

Families commonly discover the long-standing policy can’t simply continue.

Typical Premium Change

| Previous policy | Replacement policy |

|---|---|

| $1,200–$2,000/year | $4,000–$9,000+/year |

Vacant homes may need specialty coverage or limited protection. Some carriers won’t insure them at all without updates.

For heirs living out of town, the property can quickly shift from an asset to a recurring expense.

A House Keeps Moving Even When Life Pauses

One of the more difficult parts emotionally is that everyday responsibilities continue.

Grass grows.

Humidity builds inside.

Small maintenance issues appear.

Florida’s climate accelerates deterioration in empty homes. Even when no major repairs exist, carrying costs begin adding up.

Typical Monthly Holding Costs

| Expense | Approximate Range |

|---|---|

| Insurance | $300–$750 |

| Property taxes | $250–$400 |

| Utilities | $150–$300 |

| Lawn & upkeep | $100–$250 |

None of these are unusual alone. Together they often reshape the decision.

When Several Heirs Share One Property

Many inherited homes belong to multiple family members. Everyone wants to be fair, but shared ownership requires coordination.

Different financial situations, different locations, and different schedules can make even simple choices slow. Meanwhile the property continues costing money in a single estate.

For many families, selling becomes less about letting go and more about simplifying something that keeps demanding attention.

Probate Creates a Waiting Period

Another common frustration is timing. Families often decide what they want to do early but can’t act immediately.

Until legal authority is granted through probate, the property cannot be transferred. Expenses continue during this period.

What That Typically Looks Like

| Timeframe | Experience |

|---|---|

| First weeks | Arrangements and paperwork |

| Months 2–3 | Bills and insurance updates |

| Months 3–6 | Authority granted |

| After authority | Decision carried out |

The delay rarely reflects hesitation it reflects legal procedure.

The Decision Usually Becomes Practical

At first many families consider keeping the home, renting it, visiting it, or passing it down.

Then the financial picture becomes clearer.

The conversation often shifts from

“Do we want to keep it?”

to

“Does keeping it make sense for everyone?”

Florida’s tax and insurance structure answers that question sooner than most places.

When Selling Becomes the Practical Next Step

For some families, keeping the home works well. Someone moves in, repairs are manageable, and everyone agrees on a plan.

But many reach a point where the property feels less like closure and more like an ongoing responsibility coordinating upkeep, managing insurance, and making decisions from different cities.

That’s when people start looking for a straightforward way to settle things.

A traditional listing can be a good choice when the home is updated, empty, and everyone is prepared for showings and open-ended timelines.

Inherited homes often aren’t in that condition, and families aren’t always in a season of life where managing preparation and repairs makes sense.

Panhandle Real Estate Investments works with families facing situations such as:

- the home needs repairs or clean-out

- multiple heirs want a simple division of proceeds

- the estate is still in probate

- the property is vacant or difficult to maintain from a distance

- a definite timeline is preferred over uncertainty

In those cases, the purpose isn’t to rush a decision it’s to remove steps that make the process harder.

A direct sale allows families to:

- sell the property in its current condition

- choose a closing date that fits the estate timeline

- avoid preparing the home for showings

- stop ongoing carrying costs sooner

If you want to talk through what the process would actually look like, you can reach Panhandle Real Estate Investments at 850-778-2212.

Sometimes a short conversation simply clarifies the next step, whether that means selling now, later, or choosing a different path entirely.

Options Families Usually Consider

| Option | What It Requires |

|---|---|

| Move into the home | Local heir ready to live there |

| Rent the property | Repairs and management |

| Fix and list | Time and upfront cost |

| Sell as-is | Simplest estate settlement |

There’s no universal right choice only what fits the family’s situation.

Frequently Asked Questions

Do property taxes always increase after inheritance?

Often they do if homestead protection ends and the assessment adjusts toward market value.

Why does insurance change so much?

Ownership and occupancy changes require a new underwriting decision and often a new policy.

Can families wait before deciding?

Yes, but expenses continue during probate.

Is selling required?

No. Many families simply find it the most manageable option.

What matters most in the decision?

Usually ongoing monthly cost and coordination between heirs not market timing.

Final Thoughts

Handling a home after losing someone is rarely just a real estate decision. It’s paperwork, logistics, and responsibility arriving at the same time emotions are still settling.

Understanding why costs change so quickly helps families make a decision calmly instead of reactively.

For some, keeping the property works.

For others, settling it brings relief.

Either way, the goal isn’t rushing it’s clarity about what’s manageable moving forward.

About Panhandle Real Estate Investments

I’m Peyton Saluto, founder of Panhandle Real Estate Investments. For over seven years, I’ve helped homeowners across the Florida Panhandle find fair and stress-free ways to sell their homes—no repairs, no commissions, and no pressure. My goal is always to put people first and make a real difference in our communities by restoring distressed properties and rebuilding neighborhoods. If you’re thinking about selling, reach out for a no-obligation cash offer. I’d love the opportunity to help you find the best path forward.