FHA 90-Day Rule Explained: When Can You Resell to an FHA Buyer in Florida?

Buying a property and quickly reselling it is common in Florida especially with renovations, inherited homes, or distressed sales. The problem many sellers run into is simple:

An FHA buyer wants the house…

But the lender says the sale isn’t allowed yet.

This usually traces back to one regulation: the FHA anti-flipping rule.

Understanding this rule matters because violating it doesn’t just delay closing it can completely kill a deal after inspections, appraisal, and weeks under contract.

This guide explains exactly when you can sell to an FHA buyer, how to calculate eligibility, and how to avoid contract cancellations.

Why the FHA Created the 90-Day Rule

This important regulation was specifically created to safeguard home buyers throughout our Florida Panhandle communities from predatory practices.

During the early 2000s housing boom, Bay County and neighboring Gulf Coast areas experienced widespread deceptive property flipping schemes:

Properties acquired at artificially depressed prices

→ Quickly flipped at severely inflated values

→ Unsuspecting FHA borrowers purchased homes far above market value

→ Mortgage loans inevitably fell into default

→ FHA insurance funds incurred substantial financial losses

To shield Panhandle homebuyers from these unethical practices and preserve community trust, HUD implemented this critical property flipping regulation:

24 CFR §203.37a – Resale of property restrictions

This regulation does NOT prevent honest local investors like Panhandle Real Estate Investments from renovating and revitalizing properties in our community.

It simply requires a reasonable holding period and transparent documentation when resale prices increase significantly within a short timeframe.

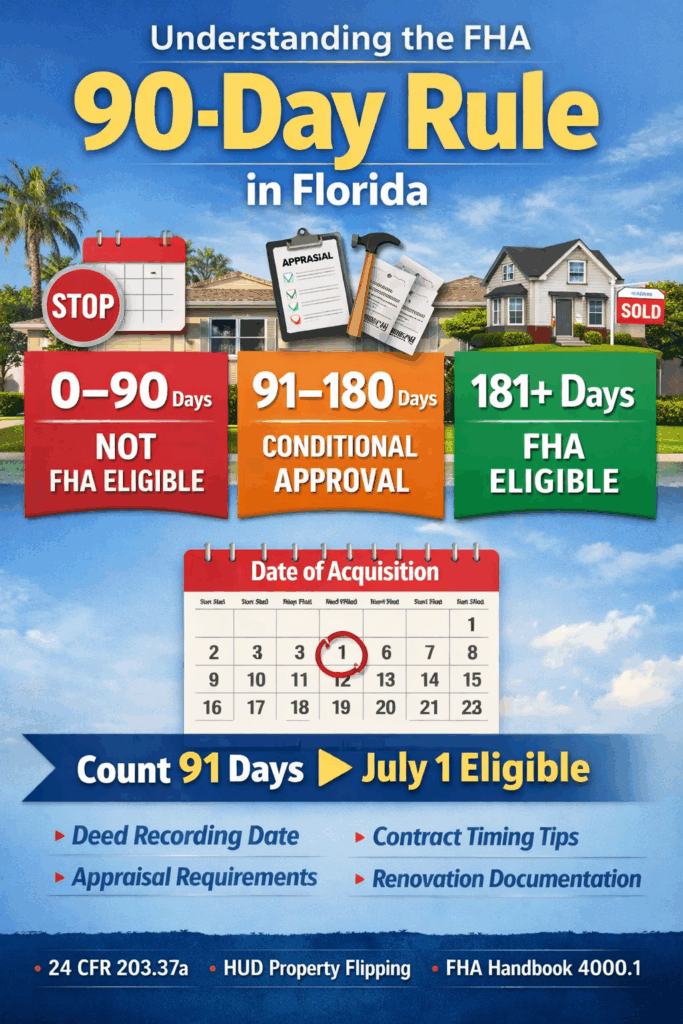

The Three FHA Holding Period Buckets

0–90 Days After Acquisition → Not FHA Eligible

The property cannot be sold to an FHA buyer.

Not “discouraged.”

Not “case-by-case.”

Flatly ineligible.

The lender will reject the loan even if appraisal, title, and underwriting are perfect.

91–180 Days → Conditionally Eligible

Now the property can be sold to an FHA buyer.

But if the resale price is significantly higher than the purchase price, the lender may require:

- Second appraisal

- Documentation of improvements

- Contractor invoices

- Permit records

- Before/after photos

- Explanation for value increase

This is where most delays happen.

181+ Days → Normal FHA Eligibility

After 181 days, FHA treats the property like any other transaction.

No extra anti-flip documentation normally required.

Appraisal stands on its own.

What “Date of Acquisition” Actually Means

This is the most misunderstood part of the rule.

The clock starts on the date your deed records not your contract date, not funding date, not possession date.

The official start date is:

The date the deed transferring ownership is recorded in public records.

If you closed on March 1st but the deed recorded March 4th

→ Day 1 is March 4th

Not the signing date.

How to Calculate Day 91 (Simple Method)

Count calendar days, not business days.

Example Timeline

| Event | Date |

|---|---|

| Deed recorded | April 10 |

| Day 30 | May 10 |

| Day 60 | June 9 |

| Day 90 | July 9 |

| Day 91 — FHA Eligible | July 10 |

You can close with an FHA buyer on July 10 or later.

Closing July 9 = loan rejection.

Can You Accept an FHA Offer Before Day 91?

Yes with a catch.

You can sign a contract earlier, but:

The closing date must be after Day 90

Most lenders also want:

- FHA case number ordered after day 90

- Appraisal scheduled near eligibility

- Contract written correctly

Otherwise underwriting suspends the file.

Practical advice:

Write the contract with a safe closing buffer (usually Day 95–100).

Can You Assign a Contract to an FHA Buyer?

No.

FHA requires the seller on the purchase contract to match the owner on title.

Assignments, double closes, and wholesales directly to FHA borrowers will fail underwriting.

However:

You CAN double close and then sell after the holding period.

What If You Made Real Improvements?

Between Day 91–180, FHA allows resale — but lenders must confirm the value increase is legitimate.

Expect scrutiny if price increased significantly.

Typical documentation requested:

Structural Improvements

- Roof replacement

- Electrical

- Plumbing

- HVAC

- Foundation work

Interior Renovation

- Kitchen remodel

- Bathrooms

- Flooring

- Windows

- Paint + fixtures (supporting evidence only)

Proof Required

- Invoices

- Receipts

- Permit history

- Contractor agreements

- Photos

No documentation = high risk of appraisal review or denial.

Common Deal-Killing Mistakes

Ordering Appraisal Too Early

Appraiser inspects before day 91 → report invalid → must redo.

Not Knowing Recording Date

Many investors calculate from closing statement date instead of deed recording date.

Huge Price Jump Without Paper Trail

Example:

Bought $120k → selling $260k in 110 days with no receipts

→ triggers FHA review

Title Seasoning Issues

If title company lists incorrect vesting history, lender flags chain-of-title.

Practical Steps to Avoid Delays

1. Verify Recording Date Immediately

Check county clerk records don’t rely on closing statement.

2. Build a Safe Closing Window

Schedule FHA closings around Day 95–105.

3. Keep Renovation Records

Store:

- Before/after photos

- Contractor invoices

- Permit printouts

4. Warn Your Listing Agent

They should disclose:

“FHA eligible after [date]”

Prevents wasted showings and cancelled contracts.

5. Prepare for Appraisal Scrutiny (91–180 Days)

Expect questions if value jumped significantly.

Example Real-World Scenario

Purchase recorded: January 5

Rehab completed: February 20

Listed: March 1

FHA buyer offer: March 10

Deal cannot close until April 6 (Day 91)

If buyer wants earlier closing → loan denied

If appraisal ordered early → must redo

If lender discovers late → contract cancels

This happens constantly in Florida markets with first-time buyers.

Where Sellers Run Into This Most Often

- House flips

- Probate/inherited properties

- Tax deed purchases

- Foreclosure resales

- Quick equity sales

- Wholesale double closes

Florida markets with many FHA buyers (like entry-level price ranges) feel this the most.

Frequently Asked Questions

Can I list the property during the 90 days?

Yes — you just can’t close to an FHA buyer yet.

Can appraisal happen before Day 91?

Technically possible but lenders often reject it — safer to wait.

Does cash buyer avoid the rule?

Yes. The FHA rule only affects FHA-insured loans.

Does refinancing reset the clock?

No. Only ownership transfer resets the holding period.

What if title transferred between my LLCs?

It may reset seasoning depending on vesting — lender review required.

Can I sell to conventional loan buyer anytime?

Yes — conventional loans do not follow FHA anti-flip rule.

Final Thoughts

The FHA 90-day rule doesn’t prevent flipping houses — it just forces transparency and timing discipline.

Most failed deals happen because sellers learn about the rule after accepting an offer.

If you calculate your eligibility date correctly and keep documentation, FHA buyers are completely workable — they just require planning.

If you want help mapping your exact eligibility date, Panhandle Real Estate Investments can calculate it for you.

Send your purchase date and property address:

📞 850-778-2212

No pressure — just clarity before you list.

About Panhandle Real Estate Investments

I’m Peyton Saluto, founder of Panhandle Real Estate Investments. For over seven years, I’ve helped homeowners across the Florida Panhandle find fair and stress-free ways to sell their homes—no repairs, no commissions, and no pressure. My goal is always to put people first and make a real difference in our communities by restoring distressed properties and rebuilding neighborhoods. If you’re thinking about selling, reach out for a no-obligation cash offer. I’d love the opportunity to help you find the best path forward.